#spinning tops candlestick pattern

Explore tagged Tumblr posts

Text

Mastering the Morning Star Pattern: A Step-by-Step Guide

Title: Mastering the Morning Star Pattern: A Step-by-Step Guide Introduction:The world of technical analysis offers traders a plethora of tools to identify potential trend reversals and market opportunities. One such powerful pattern is the Morning Star pattern, a three-candlestick formation that signals a potential bullish reversal after a downtrend. In this step-by-step guide, we will explore…

View On WordPress

#bullish reversal#candlestick patterns#comprehensive trading approach.#confirmation factors#doji candle#downtrend#false signals#market sentiment#momentum shift#Morning Star pattern#position sizing#price action#resistance levels#Risk Management#spinning top#stop-loss#support levels#technical analysis#trading strategy#trading volume#Trend Reversal#volume analysis

0 notes

Text

Candlestick Patterns: Mastering Market Moves with Accurate and Profitable Setups

In technical analysis, Candlestick Patterns are among the most powerful tools traders use to predict price movements. These patterns, originating from Japanese rice traders in the 18th century, provide visual cues about market sentiment, momentum, and potential reversals.

While there are dozens of candlestick formations, not all are equally reliable or easy to use. In this guide, we will focus on the most accurate and easy-to-understand candlestick patterns that offer strong profit potential, especially for swing traders and intraday traders.

What Are Candlestick Patterns?

A candlestick represents the price movement of an asset within a specific timeframe (e.g., 5-minute, daily, weekly). Each candlestick shows four key prices:

Open

High

Low

Close

The body (thick part) shows the range between the open and close. The wicks (or shadows) show the highs and lows. A green (or white) body shows a bullish candle, while a red (or black) one shows a bearish candle.

When grouped, Candlestick Patterns reveal momentum, reversals, or continuation of trends—making them highly valuable for timing trades.

1. Bullish Engulfing Pattern – Strong Buy Signal

Structure: A small red candle followed by a larger green candle that completely engulfs the previous day’s red candle.

Meaning: It indicates a strong reversal from bearish to bullish sentiment.

Best Used In: Downtrends or near support zones.

✅ Why It Works: It shows buyers stepping in with strong conviction, overpowering the previous day’s sellers.

2. Bearish Engulfing Pattern – Strong Sell Signal

Structure: A small green candle followed by a larger red candle that engulfs the previous green one.

Meaning: Suggests a reversal from bullish to bearish sentiment.

Best Used In: Uptrends, especially after a rally.

✅ Why It Works: It often signals that buyers are exhausted and sellers are gaining control.

3. Hammer – Bullish Reversal Pattern

Structure: Small body with a long lower wick, usually forming after a downtrend.

Meaning: Buyers rejected lower prices, showing potential for reversal.

Best Used In: Downtrends or oversold markets.

✅ Why It Works: Signals exhaustion of selling pressure and potential entry of buyers.

4. Shooting Star – Bearish Reversal Pattern

Structure: Small body with a long upper wick after an uptrend.

Meaning: Price attempted to rise but failed, indicating weakness.

Best Used In: Uptrends or near resistance.

✅ Why It Works: It highlights a failed rally, often followed by price correction.

5. Doji – Indecision, But Powerful with Confirmation

Structure: Very small body with long wicks, showing close is near the open.

Meaning: Market is undecided—watch for what happens next.

Best Used In: At the top or bottom of trends.

✅ Why It Works: Dojis often precede reversals, especially when followed by strong confirmation candles.

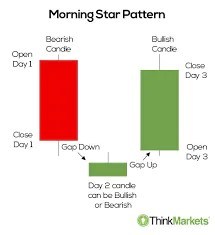

6. Morning Star – Bullish Reversal

Structure: A three-candle pattern: a long red candle, followed by a small body (Doji or Spinning Top), and a strong green candle.

Meaning: Shift from bearish to bullish momentum.

Best Used In: Downtrends or after corrections.

✅ Why It Works: Indicates transition from selling pressure to strong buying.

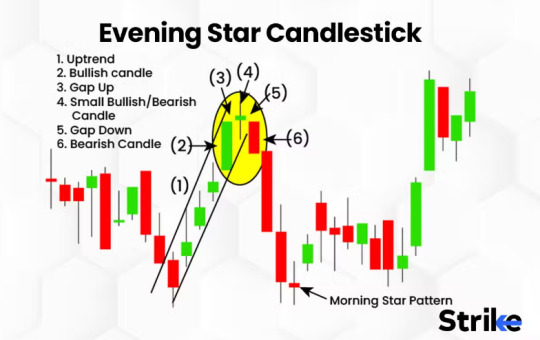

7. Evening Star – Bearish Reversal

Structure: Long green candle, followed by a small-bodied candle, then a long red candle.

Meaning: Sign of exhaustion in an uptrend, often preceding a downtrend.

Best Used In: Uptrends or after a bullish rally.

✅ Why It Works: Shows that buyers are losing steam and sellers are gaining control.

How to Maximize Profits with Candlestick Patterns

🔎 1. Combine with Support and Resistance

Candlestick patterns are more effective when they occur at key technical levels. For example, a Bullish Engulfing pattern at strong support offers a higher probability of success.

⚙️ 2. Use in Conjunction with Indicators

Pair candlestick patterns with tools like Relative Strength Index (RSI) or Moving Averages to confirm trend reversals or continuations.

⏱️ 3. Focus on Volume Confirmation

High volume on the reversal candle adds credibility to the signal. Volume confirms the participation of institutional players.

📈 4. Time Your Entry and Exit

Don’t trade on the pattern alone. Wait for confirmation candles or enter on the next candle’s break of the reversal level. Set clear stop-losses below/above the pattern for safety.

Final Thoughts

Candlestick Patterns are essential for anyone looking to understand price action and predict market behavior. When used correctly, patterns like the Bullish Engulfing, Hammer, and Morning Star can offer high-probability entry points for profitable trades.

What separates successful traders from the rest is not just identifying patterns but using them in the right context—with support, volume, and indicators backing them up. Simplicity, accuracy, and discipline are the keys to making candlestick patterns a reliable part of your trading strategy.

0 notes

Text

Types of Candlestick Patterns Explained Simply

Types of Candlestick Patterns: A Beginner-Friendly Guide

Have you ever looked at a stock chart and felt like it was speaking a foreign language? Those little red and green bars—known as candlesticks—aren’t just random shapes. They tell stories. Stories of fear, greed, hesitation, and opportunity. If you've ever wished to understand those stories, you're in the right place.

In this article, we’re going to explore the types of candlestick patterns in a way that’s easy to grasp, even if you're brand new to trading. Think of candlestick patterns like emojis—small symbols packed with emotional context. Just as means happiness, a Hammer candlestick might signal a bullish reversal.

Explore types of candlestick patterns in simple terms. A complete guide to all types of candlestick patterns for beginners and curious traders.

Introduction to Candlestick Patterns

Candlestick patterns are visual tools used in stock trading to predict potential price movements. Each candlestick shows four key details: the opening price, closing price, highest price, and lowest price for a specific time frame.

These patterns originated in 18th-century Japan—yes, that far back!—when rice traders used them to predict future prices.

Why Candlestick Patterns Matter

Understanding candlestick patterns is like learning to read body language. While price tells you what happened, candlesticks hint at why. Are traders getting scared? Is there confidence building up? Candlestick patterns provide these answers through easy-to-spot formations.

Single Candlestick Patterns

Let’s begin with the simplest types. These involve only one candlestick and are often the first step for beginners.

The Hammer & Hanging Man

These two look nearly identical but mean very different things.

Hammer: Appears at the bottom of a downtrend. Think of it as the market “hammering out” a bottom. It has a small body and a long lower shadow.

Hanging Man: Shows up after an uptrend. Same shape as the hammer but signals a potential drop in price.

Tip: The color of the body isn’t as important as the position and size of the shadow.

Doji – The Market's Pause Button

The Doji is like a moment of hesitation. The opening and closing prices are nearly the same, forming a tiny body.

Types of Doji:

Neutral Doji: Price goes up and down, but ends unchanged.

Long-legged Doji: Large wicks on both sides, signaling major indecision.

Gravestone Doji: Looks like an upside-down “T” and suggests bearish pressure.

Dragonfly Doji: Resembles a “T” and may signal bullish strength.

Spinning Top – Indecision Alert

A Spinning Top has a small body and long upper and lower shadows. It signals that buyers and sellers fought hard but neither won.

It usually shows up during a trend and indicates a possible reversal or slowdown.

Marubozu – Full of Confidence

This candlestick has no shadows—just a solid body.

Bullish Marubozu: Opens at the low and closes at the high. Total buyer control.

Bearish Marubozu: Opens at the high and closes at the low. Total seller control.

Think of it like someone shouting, “I’m all in!” without hesitation.

Engulfing Patterns – Power Shifts

These are two-candlestick patterns that reflect changing momentum.

Bullish Engulfing: A small red candle followed by a large green one that "engulfs" it. Suggests a reversal to the upside.

Bearish Engulfing: Opposite of the above, often indicating a drop ahead.

Morning Star & Evening Star

These are three-candle patterns that often signal major turning points.

Morning Star: Appears after a downtrend. A long red candle, then a small one (any color), followed by a strong green candle. Signals a bullish reversal.

Evening Star: The bearish cousin. Appears after an uptrend.

Three White Soldiers & Three Black Crows

These are sequences of three strong candles.

Three White Soldiers: Three long green candles in a row. Very bullish.

Three Black Crows: Three long red candles. Very bearish.

These patterns indicate strong sentiment, either positive or negative.

Harami – Inside Moves

The Harami pattern looks like a small candle hiding inside a larger one.

Bullish Harami: Small green candle inside a large red one. Signals a possible reversal upward.

Bearish Harami: Small red inside a green. Signals a potential downturn.

Piercing Line & Dark Cloud Cover

These two-candle patterns are also all about reversal signals.

Piercing Line: A red candle followed by a green one that opens lower but closes past the midpoint of the previous red. Bullish sign.

Dark Cloud Cover: The opposite. Bearish sentiment taking over.

Tweezer Tops and Bottoms

Tweezer Top: Two or more candles with identical highs. Suggests price resistance and a possible drop.

Tweezer Bottom: Identical lows over two or more candles. Suggests price support and possible rise.

Think of tweezers picking the top or bottom out of a price trend.

How to Read Candlestick Patterns Together

One candle alone doesn't tell the full story. It's like reading just one sentence of a novel. To truly understand the plot, you need context. Combine patterns with:

Volume

Trend direction

Support and resistance levels

Tips for Using Candlestick Patterns Effectively

Don’t trade patterns in isolation. Always confirm with other indicators.

Practice makes perfect. Use demo accounts to test your pattern-reading skills.

Stay patient. Candlestick patterns are signals, not guarantees.

Conclusion

Candlestick patterns are like the facial expressions of the stock market. They give you hints, nudges, and sometimes loud warnings about what might happen next. Whether you’re just curious or planning to dive deeper into trading, understanding these patterns will help you navigate the charts with confidence.

Remember, while this article covers all types of candlestick patterns, experience and context make all the difference in using them effectively.

FAQs

What are candlestick patterns in simple terms? Candlestick patterns are visual tools on price charts that show how a stock's price moves during a certain period, helping predict future movements.

How many types of candlestick patterns are there? There are over 30 commonly used candlestick patterns, including single, double, and triple candlestick formations.

Are candlestick patterns reliable for trading? They can be helpful indicators but should always be used with other tools like volume and trend analysis for accuracy.

What is the most bullish candlestick pattern? The “Morning Star” and “Three White Soldiers” are among the most bullish, often indicating a strong reversal to the upside.

Can I use candlestick patterns in all markets? Yes! These patterns work in stocks, forex, commodities, and crypto markets, thanks to their universal price action behavior.

#types of candlestick patterns#all types of candlestick patterns#types of candlesticks#types of candlesticks and their meaning

0 notes

Link

#CandlestickPsychology#chartpatterns#ConsolidationPatterns#Doji#DragonflyDoji#ForexTrading#GravestoneDoji#HighVolatilitySignals#IndecisionPatterns#InsideBar#Long-LeggedDoji#MarketSentiment#MarketUncertainty#marketvolatility#Marubozu#NeutralCandlestickPatterns#priceaction#PriceActionAnalysis#ReversalSignals#riskmanagement#SpinningTop#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendExhaustion#TrendReversal#TrendWeakness

0 notes

Text

Using Trading Patterns in Forex Trading

Knowing and using different types of patterns is the basis for successful trading, as every market situation requires choosing the most optimal and, consequently, profitable course of action. Therefore, it is worth taking a closer look at different Forex trade patterns. Understanding Trading Patterns It is the result of studying historical data on the behavior of financial markets over decades. This makes it possible to identify repeated formations, which form chart patterns. With a high probability, they are the ones that predict future price changes, which is why, along with a Forex expert advisor, they are among the main tools for a trader. It is important to understand that chart patterns are divided into two main categories: Reversal Continuation Each of them includes different types of charts that characterize the market and provide information about further trend changes, which is especially important for successful trading. Common Reversal Patterns These patterns in Forex trading indicate trend reversals. It can be a change of direction from a falling market to a rising one or vice versa. They usually take the form of head and shoulders, as well as double or triple tops and bottoms. Reversal patterns indicate a fairly high potential risk-reward ratio. The following chart patterns in Forex are the most popular among traders. Head and Shoulders. This chart has three price peaks. The one in the middle is higher, and the two on the sides are at about the same level. A double-top pattern. It usually occurs after an uptrend. The chart has two peaks at almost identical heights. This pattern indicates that buyers are running out of steam. The last bottom between the two peaks is called the trigger line. Double bottom. This chart is the exact opposite of the previous one. It is helpful to use it after a significant price drop. The Quasimodo pattern. It is one of the most reliable patterns for determining the reversal strength. This pattern can be especially useful after a significant downtrend or uptrend. Candlestick pattern. The chart resembles a candle, which is why it has such a name. If this pattern appears after a significant downtrend, it may indicate that new opportunities for price growth may appear soon. Continuation Patterns Typically, continuation patterns include descending and ascending triangles, rectangles, pennants, and bull and bear flags. This indicates that after a period of consolidation, the prevailing trend will continue. Elongation patterns usually appear in the middle of a trend. In general, they are a pause in price action and can have different durations. Therefore, it is worth paying special attention to different models of continuation patterns. Triangle. This chart shows the convergence of a price range with higher lows and lower highs. There is a descending, ascending, and heptagonal triangle. Pennants. This pattern is similar to the previous one but smaller because it is created by only a few bars. The chart appears when prices are converging and cover a small price range of the average trend. Flags. Flags indicate a pause in the trend that occurs when the price is limited to a small range. This pattern usually does not last long. Rectangles. This chart indicates a pause in the trend. Price action moves between parallel support and resistance lines. Japanese Candlestick Patterns Such charts are also called spinning tops. They indicate a certain confrontation between buyers and sellers. Prices can go up and down quite sharply, but as a result, no dramatic changes occur. If a spinning top is formed during an uptrend, you should expect its direction to reverse, as there are few buyers left. If a rotating top is formed during a downtrend, it also indicates a trend reversal, but the reason is a small number of sellers. Also, special attention should be paid to the Marubozu model. There are Black and White versions of this chart. An extension is likely when the White Marubozu is formed at the end of an uptrend. If this chart is created at the end of a downtrend, a reversal is likely. The situation is the opposite with the Black Marubozu. Another variant of the Japanese candlestick pattern is the Doji. They indicate the same opening and closing price, which is caused by the struggle or indecision between buyers and sellers. Trading Strategies Based on Patterns Recognizing different trading patterns is a particularly important skill for investors. It involves identifying patterns in the behavior of assets on the market, which makes it possible to create more accurate forecasts of market trends and, accordingly, choose the best strategies. Among them, the most popular are the following: Moving average strategy; 50 pips per day; Breakout/breakdown strategy; Trading by graphic patterns; Trend following strategy; Scalping. Summary Trading models provide valuable information about the dynamics of supply and demand, as well as market psychology. With this information, an analyst can assess possible future trend changes and choose the most successful trading strategies based on it, maximizing the profit. Read the full article

0 notes

Text

BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital Options BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital OptionsThe ultimative Price Action guide (7 edition) for any kind of financial instrument (Binary Options, Forex, FX Options, Digital Options) any kind of time frame from 1 min over 5 min up to 15 min, 30 min and above and any kind of broker. This ebook is all you need, especially as a binary option turbo trader or Forex day trader to get profit out of the market, to get out of debt, make yourself a living or help your friends and family and to archieve financial freedom. Don't miss the opportunity to get this ultimative Price Action guide (7 edition)File Size: 12597 KBPrint Length: 118 pagesPublisher: BO Turbo Trader; 7 edition (October 24, 2018)Publication Date: October 24, 2018Content:Mindset for consistent profits- Practice- Win Rate- Discipline- Money Management- Emotions Candlestick Patterns- Hammer, Inverted Hammer, Takuri Line, Shooting Star and Hanging man- Dragonfly Doji, Gravestone Doji- spinning top - long-legged doji, high wave and rickshaw man- Pinbar - Pin Bar - Pinocchio bar or Kangaroo Tail - Tweezer Top and Tweezer Bottom- bearish harami, bullish harami and bullish harami cross and bearish harami cross- three inside down, three inside up- descending hawk and homing pigeon- bearish meeting line - counterattack line and bullish meeting line- bearish belt hold - black opening shaven head - black opening marubozu- bullish belt hold - white opening shaven bottom - white opening marubozu- bearish kicker signal - bullish kicker signal- matching high and matching low- bearish stick sandwich and bullish stick sandwich - bearish breakaway and bullish breakaway- ladder top and ladder bottom - tower top and tower bottom- three stars in the north and three stars in the south- bearish sash pattern and bullish sash pattern- engulfing candlestick pattern or the big shadow pattern- (bearish) dark cloud cover and (bullish) piercing line- Breakaway gap, exhaustion gab, continuation gap and common gaps- rising window and falling window- marubozu and big belt- inside bar and mother bar- evening star, morning star and evening doji star and morning doji star- three white soldiers and three black crowsChart Patterns- Double Top - M Formation - Mammies and Double Bottom - W Formation - Wollahs- J-Hook pattern and inverted J-Hook candlestick pattern- bearish last kiss - bearish pullback and bullish last kiss and bullish breakout- Head and Shoulders and inverted Head and Shoulders Pattern- Trend Channel - uptrend and downtrend- symmetrical triangle- ascending triangle and descending triangle- bullish flag and bearish flag - bullish pennant and bearish pennant - rising wedge and falling wedge- Broadening Bottoms and Broadening Tops- Rectangle Bottoms and Rectangle TopsConcepts- Candlestick Mathematics- Rejection - market move - weak snr and strong snr- trending and ranging market- minor and major trend- adapting forex strategies to binary options turbo trading- proper rejection - invalid rejection- false breakouts - channel breakouts- reversal and retracements- highest probability trading setups- high probability techniques- market pressures and types of market pressures- upper shadow and lower wick or tail- advanced candlestick charting techniques- overbought and oversold - oscilator - RSI CCI Stochastic Oscilator- different market conditions and market conditions examples- cycle of market emotions, psychology and dynamics- trading setups without rejections as confirmation - multiple time frame trading concept, system, methology and strategy- candlestick momenting- direction of candlestick momentum- inside swing and outside swing- support and resistance - minor snr and major snr and much more concepts ... Also by the same author: BOTT Mentorship Self-Study Video Pack 1-4 BOTT Price Action Indicator BOTT Price Action Bible by BO Turbo Trader

0 notes

Text

Understanding the Bullish Spinning Top Candlestick Pattern: A Guide to Interpretation and Trading Strategies

Candlestick patterns are vital tools for technical analysts, offering insights into market sentiment and potential price movements. Among these patterns, the Bullish Spinning Top stands out as a significant indicator of potential bullish reversals or continuation trends. This article explores the Bullish Spinning Top candlestick pattern in detail, covering its characteristics, interpretation, trading strategies, and practical examples.

What is a Bullish Spinning Top Candlestick Pattern?

A Bullish Spinning Top is a single candlestick pattern characterized by its small body and long upper and lower shadows. It forms when the opening and closing prices are relatively close to each other, resulting in a small body, while the shadows or wicks extend significantly above and below the body. The pattern suggests indecision between buyers and sellers, often occurring after a period of price consolidation or during a potential reversal.

Key Characteristics of a Bullish Spinning Top:

Small Body: The body of a Bullish Spinning Top is small, indicating that there is little difference between the opening and closing prices. This reflects indecision in the market.

Long Upper and Lower Shadows: The presence of long upper and lower shadows suggests that prices moved significantly higher and lower during the trading session. These shadows indicate that both buyers and sellers were active but did not achieve a decisive outcome by the close of the session.

Position within Trend: A Bullish Spinning Top can appear in both uptrends and downtrends. In an uptrend, its presence may indicate potential hesitation or minor profit-taking before continuation. In a downtrend, it might signal a potential reversal or a pause in selling pressure.

Interpreting the Bullish Spinning Top Pattern:

Market Sentiment: The Bullish Spinning Top suggests a temporary pause in the prevailing trend due to indecision among market participants. It indicates that neither bulls nor bears have gained control by the close of the session.

Potential Reversal Signal: When a Bullish Spinning Top forms after a prolonged downtrend, it could signal a potential reversal to the upside. The small body and long shadows indicate that sellers are losing momentum, and buyers may start to gain control.

Confirmation: To validate the Bullish Spinning Top pattern, traders often look for confirmation in the form of higher prices in subsequent trading sessions. A strong bullish candle following the pattern can confirm bullish momentum and potential continuation.

Trading Strategies with Bullish Spinning Top:

Entry Strategy: Traders may consider entering long positions when a Bullish Spinning Top forms, ideally at or slightly above the high of the candlestick. This entry strategy aims to capture potential upward momentum following the pattern.

Stop-Loss Placement: Place a stop-loss order below the low of the Bullish Spinning Top candlestick to protect against potential downside risks. This level serves as a point where the pattern's bullish implications may be invalidated.

Profit Targets: Set profit targets based on technical analysis tools such as Fibonacci retracements, trendlines, or previous resistance levels. Adjust targets based on market conditions and the strength of the bullish trend confirmed after the pattern.

Example of Bullish Spinning Top in Trading:

Let's consider an example to illustrate the application of the Bullish Spinning Top pattern:

Scenario: Stock XYZ has been in a downtrend for several weeks due to profit-taking and market sentiment. A Bullish Spinning Top forms on the daily chart, with a small body and long upper and lower shadows.

Interpretation: The Bullish Spinning Top suggests that selling pressure is weakening, and buyers are beginning to show interest. Traders may interpret this as a potential reversal signal, anticipating a shift in momentum from bearish to bullish.

Trading Strategy: A trader decides to enter a long position slightly above the high of the Bullish Spinning Top candlestick, with a stop-loss placed below its low. Profit targets are set based on resistance levels identified on the chart or through technical analysis tools.

Conclusion

The Bullish Spinning Top candlestick pattern is a valuable tool for traders seeking to identify potential reversals or continuation trends in the market. Its formation indicates indecision between buyers and sellers, often leading to a temporary pause in the prevailing trend. By understanding the characteristics, interpretation, and trading strategies associated with the Bullish Spinning Top, traders can enhance their ability to make informed decisions and capitalize on market opportunities effectively.

Incorporating technical analysis alongside fundamental factors can further validate the signals provided by candlestick patterns, ensuring a comprehensive approach to trading strategies. Whether used independently or in conjunction with other indicators, the Bullish Spinning Top pattern offers valuable insights into market dynamics and price action, aiding traders in navigating the complexities of financial markets with greater confidence and precision.

0 notes

Text

0 notes

Text

The Pepe price prediction illustrates that the Pepe price has been making candlestick patterns like doji and spinning tops after a drop, which signals a weakening of the buyers that caused the breakdown of the recent support and the price declined to a lower level. The daily chart reveals that the PEPE price has been on a steady decline for the last 6 months, erasing the profits and falling further. The buyers’ efforts were turned into pullbacks each time and this made the price suffer a continuous slump. The PEPE crypto price plunged nearly 36% in August 2023, hitting the lower boundary of a channel pattern formed on the daily chart. Lately, the PEPE crypto has made a new swing low after breaking below the previous one. Pepe Price Prediction Using Price Action Strategy The PEPE price currently trades at $0.00000064 and made a breakdown of the recent support to slide at the lower level. The price is again showing a consolidation after the breakdown at the lower levels and showing no signs of recovery till now. The Pepe price might resume its decline if it breaks below the consolidation. The volume analysis shows that the Pepe crypto has received $57.18 Million volume in the past 24 hours with a gain of 121.21% from the past day. The volume-to-market cap is 22.2% which indicates high volatility in the crypto. The crypto holds a market cap of $252.36 Million with a decline of 3.09% in the last 24 hours. PEPE Price Forecast From Indicators’ Point of View As per the EMA analysis, the PEPE price has dropped below the 50-day and 200-day EMA indicating a bearish trend in the crypto. The price might suffer rejection from the EMAs if surges higher. The relative strength index (RSI) line is currently trying to recover after entering the oversold level, positioned below the 14-day SMA. This suggests a bearish crossover with the 14-day SMA, indicating weakness in the price of PEPE in the near future. The present value of stochastic RSI is 34.04 points whereas the 14-day SMA is moving around 32.6 points. Conclusion PEPE price prediction shows that the Pepe price has been declining for the last 6 months, making candlestick patterns that indicate a loss of buyers’ strength. The price broke below the recent support and hit the lower edge of a channel pattern on the daily chart. The price is consolidating at the lower levels with no signs of recovery. The volume is high and volatile, indicating a possible further drop. The crypto has a market cap of $252.36 Million and trades at $0.00000064. Technical Levels Support levels: $0.00000065 and $0.00000041. Resistance levels: $0.00000086 and $0.00000123. Disclaimer Source

0 notes

Text

What is The Spinning Tops Candlestick Pattern? Is it bullish signal or bearish signal? Is it most significant candle or not? Where to find it in bottom or in top? where to trade with it and where to not? what are the best trading strategies for this candlestick pattern? These All Points has discussed in this blog. Read Now.

#candles#candlestick#candlestick pattern#candlestick patterns#bearish candlestick pattern#spinning tops candlestick pattern#spinning tops candle#spinning top pattern#trading strategy

0 notes

Link

At least once in your trading life, you must have seen these charts wondering what these really are. These complex yet simple charts are the backbone of any trader and are known as Candlestick Patterns.

0 notes

Note

Since I apparently can no longer go near a church or candles without thinking of a certain priest... I'm throwing this to your muse, in case she sparks anything.

My dear @sweetestgbye, thanks for leaving your confession in my ask box. ⛪️ and🕯you say? I hope you'll like what my muse came up with. 💛

Burning Desire

Fandom: The Man from Rome

Relationship: Father Quart x OC Lucia

Warnings: 18+

The wax is warm and soft under her fingertips, and Lucia gently squeezes the top of the candle. The edge bows to her will and collapses in the already melted wax. She smiles as the flame seems to take a deep breath and then returns to its original shape.

”You should not play with candles.” A dark and slightly intimidating voice, coming from behind, sends a shiver down her spine. She can tell the man is standing close to her—too close to be considered a coincidence. ”You might get burned.”

Lucia doesn't have to look over her shoulder, she knows the deep, alluring voice belongs to the man she spent over an hour to both seduce and ignore at the same time.

The church was packed when she finally found a spot for herself, and when she looked out over the ocean of faces, she instantly noticed him. A bit taller than the people seated next to him, he really stood out from the crowd. Not only by his looks, even if he is incredibly handsome, but an unusual calmness appeared to surround him. The enigmatic man was seated a few pews behind her, and every time she turned her head, their gazes met. When she tried to focus on the choir and the beautiful Christmas songs that seemed to float through the air, she could feel his piercing gaze burning the skin on her neck. Her long, blond hair was arranged in a messy bun, leaving her neck fully exposed. When she made her scarf slip on purpose, she instinctively knew he took notice. And she loved it.

She squeezes the candle again, and this time the melted wax drips down the length of the slim candle. With great fascination, Lucia watches how a beautiful pattern takes form, but eventually, the heavy candlestick stops the wax from continuing its journey.

”I don’t mind the heat from the wax, it can be controlled.” The words slip from her, and she bites her lower lip. Why did she say that? Lucia moves her fingers to the slightly taller candle, second in line at the altar. She repeats her small assault on the new candle, but as it starts to give in, she doesn’t remove her hand. The warm wax slowly drips over her fingers, but she doesn’t flinch nor withdraw. Instead, she closes her eyes and breathes through her nose. It’s hot, yet not unbearable, but the smell from the burning candles is abruptly replaced by an unfamiliar, musky scent that makes her knees weak. Suddenly a large hand clasps around her wrist and pulls her fingers away from the candle. She spins around and meets the man’s cerulean stare.

”Inflicting pain on yourself is a sin.” If he spoke louder, his voice would roll between the stone walls in the church like thunder, but now, as he speaks in a hushed tone, his words find their way under her skin and make her heart beat faster. The man is much taller than she expected, and he towers over her as he gazes down at her hand. His hair is dark, kissed by age at his temples, and in his stubble she can read the traces of experience and sacrifice. He wears a dark suit, an aegean shirt, and around his neck—the evidence of his calling—a white clergy collar. Lucia swallows hard; he looks even more handsome up close.

”Is it still considered a sin if I ask someone else to inflict pain upon my skin?” she whispers, too overwhelmed by his appearance to be able to command her tone.

”It depends,” his voice drops even lower, and it makes her tremble. ”Is the pain for penance, or simply your own satisfaction?” Lucia gasps at his words. Who is this man? He is not a usual priest, and something in his eyes reveals that he has seen far more than the average man. And yet she can’t deny it; the quite intriguing look in his eyes gives her a thrill unlike anything she has ever felt.

”Both,” she lowers her gaze but registers the change in his eyes. A storm is approaching, and she's without shelter. Against his demeanor, she stands defenseless. She should have known; she felt the raw attraction when seated in the pew, and now, as he exposes his true self, Lucia is struggling to keep her feelings under control.

”Why these candles?” His voice is sharp, but she senses a curious question behind the scolding tone.

Lucia lets her gaze fall back on the candles standing on the altar. They flicker as a result of her disobedience.

”They are beautiful.” Her answer is simple—too simple to be the whole truth. She didn’t expect to have this conversation, at least not here, so soon, and she is not yet ready to reveal the real reason behind her act. ”And I like to push my limits.” Her last words are only a soft whisper, even if the last visitors left the old church a while ago.

”That can be done in many other ways.” His remark surprises her, and she turns to face him again.

”I know.”

A long pause follows, questions lurking in the silence between them, and Lucia perceives how she’s physically drawn to the man, as if he’s the strongest magnet and she a thin needle.

”How long has it been since your last confession?” Another surprising question, and she lowers her gaze, slightly embarrassed.

”Too long I assume,” Lucia mumbles. It’s the truth. She was raised catholic, but as an adult, she struggles to feel included. Still, she enjoys visiting church, but when she does, it’s mainly for the music and the possibility to admire the grand architecture and the paintings.

”So it’s pleasure you’re seeking then, not penance.” Something in his words ignites her inner fire, and she lets out an involuntary, longing sigh.

”May I ask your name?” She can hear her own voice tremble slightly.

”Quart.” His reply is instant and harsh, like the crack from a whip being wielded in the air.

”Tell me, Father, why are you asking me all this? What are you seeking?”

Father Quart ponders over her question; he’s not really sure himself. Recently he has questioned his choice in life. The sometimes shady work he does for the Vatican comes with a high price. He knows Monsignor Spada expects him to carry on, but there are many nights when Father Quart dreams of another life. A life without a vow of celibacy.

The woman before him is beautiful, yet something tells him she might not realize it. She is almost a head shorter, with a golden glow in her blond hair, which reminds him of a burning match. Her neck is long, and her skin pale. But it’s not her features he finds irresistible; it’s the depth of her eyes. She’s a seeker, but not only for spiritual guidance.

Without even thinking of it, Father Quart lifts his hand and strokes the collar around his neck. For some reason, it feels heavier now than it did when the sun broke free from the night, but not even the smallest muscle in his face reveals his inner struggle as he speaks. ”I have found my place.”

Lucia watches him in silence and nods. It makes sense to her, but she can’t shake away the feeling of a growing bond between them—unspoken yet undeniable.

”My name is Lucia,” she then says and smiles warmly at him.

Father Quart smiles back, but it’s a restrained smile, forced upon his lips, for her mouth moves sensually when she speaks, and he can’t hinder his own thoughts. In fact, he doesn’t want to. He watches her hand, the one he pulled from the candle, as she reaches out and strokes the altar.

Lucia looks around in the empty church and back at the man she now knows as Quart. Father Quart, she corrects herself.

”Will you hear my confession, Father?” Her voice is once again only a seductive whisper.

Father Quart closes his eyes briefly to gather his thoughts. It has been a long time since he helped a parishioner in confession, but he can’t refuse. When he opens his eyes, she looks straight at him with an expression he has not seen in many years.

”If that is your wish.”

She smiles and makes the sign of a cross. ”Forgive me, Father, for I have sinned. It’s been so long since my last confession, I can’t even remember when it was.”

Father Quart chooses to stay silent and allows Lucia to find her own pace. Soon, a stream of words start falling from her lips, spoken calmly and detailed. She doesn’t hold back when she explains her lust and desire. How she needs a man who can satisfy all her needs. Father Quart remains silent and listens to how she carefully changes her focus toward the candles, the melted wax—and the altar. Her admiration for their beauty becomes very clear to him, and the strange feelings they awake in her. She doesn’t have to say it out loud. He can still read the forbidden fantasy in her eyes; Lucia, lying naked on the cold altar with a man standing beside her and painting her body with dripping, warm wax. And Father Quart has a good understanding of who that man should be. Then she falls silent, as if lost in her own thoughts. He waits, but when she neither continues nor ends her confession, Father Quart decides to speak.

”Lucia, your confession doesn’t sound like you’re truly regretting your thoughts.”

She doesn’t respond, but a sweet blush caresses her cheekbones, and Father Quart notices the smallest shift in her eyes. He recognizes that look—guilt—and it only confirms his suspicions. ”I don’t think it's the Lord’s forgiveness you want, so what is it? Why are you telling me this?”

She captures his gaze and holds it steadily. ”Can’t you feel it? Or are you just too afraid to acknowledge it?”

Father Quart knows exactly what she’s talking about, for it has been on his mind ever since he grabbed her hand. Her soft skin against his was enough to wake his desire. He’s drawn to her, a powerful attraction—yes—but also on a deeper level. He senses they are more alike than he’s comfortable with. Her needs mirror his own, only he has spent years suppressing his carnal lust. He takes her hand in his and holds it closer to the candle. No red marks or traces of wax can be seen on her delicate fingers, and Lucia is standing completely still, as if waiting for something. At that moment, Father Quart realizes he wants to see the melted wax drip down on her again. And he yearns to see those beautiful eyes in front of him burn with passion.

”You want me to do this to you, don’t you?” His voice grows thick when he meets her gaze, and the strong need in her eyes almost makes him lose control. Almost.

”Yes,” she breathes. ”More than anything.”

💙 If you like my writing, please consider spreading the love and reblogging.💙

Taglist and others who might be interested: @lathalea @legolasbadass @laurfilijames @i-did-not-mean-to @enchantzz @fizzyxcustard @middleearthpixie @xxbyimm @bitter-sweet-farmgirl @kibleedibleedoo @mariannetora @haly-reads @sunnysidesidra @rachel1959 @knittastically @jaskierthelover @quiall321 @medusas-hairband @fulltimecrazy @s0ftd3m0n @emrfangirl @glimmering-darling-dolly @lilith15000 @clumsy-wonderland @theawkwardbutterfly

Let me know if you want to be added or removed.

#richard armitage#father quart#father quart fanfic#father quart fanfiction#the man from rome#la piel del tambor#ficlet#father quart x oc

60 notes

·

View notes

Text

Mirror, Mirror Finale P.2

masterlist request guidelines

pairing: draco x ravenclaw reader

request: yes very highly requested lol

summary: despite never speaking before, y/n has a big crush on draco malfoy, a particularly broody and obnoxious slytherin. what will happen when they finally have to start associating? and what if they run into a certain mirror that shows you what you truly desire?

warnings: cursing!

a/n: so ik i said this was gonna be out later this week but i love you guys too much! here it is...the final part of mirror, mirror! it’s weird to finally finish a series like this but ohhhh boy here we are

taglist: @theres-a-dog-outside-omg @mey-rapp @kaibie @blackpinkdolan @the-wiener-soldierrrrr @sugarbby99 @gruffle1 @missmulti @cleopatera @hahaboop @accio-rogers @geeksareunique @eltanin-malfoy @war-sword @cams-lynn @itsivyberry @ayo-cowbelly @nerd-domland @yesnerdsblog @shizarianathania @evanstanfanatic @strawberriesonsummer @hariosborn @night-ving @straightzoinked @imintoodeeptostop

word count: 2.1k

“About time you got off your arse.”

“Hello to you too, Rena,” Y/N sighed as she dropped her satchel on her bed. Her roommate watched, bemused, as she began to unpack her things.

“How are you?” she asked, her voice noticeably softer. “I really missed you. We were all worried sick, you know.”

Y/N snorted, tossing her wrinkled robes on the bed and making a mental note to spell them neat later. “I do know. Madame Pomfrey was going to kill me for how many times she had to tell you to leave me and let me rest.”

Rena’s eyes sparkled.

“I’m fine, thank you,” said Y/N. “I missed you too.”

The two sat in silence for a bit as the cold afternoon breeze wafted into their room, carrying the smell of fresh snow in.

“So, anything exciting happen? Did anyone tell you anything….interesting?”

“No.” Y/N was about to turn back to her work before she caught the mischievous expression on Rena’s face. “What? Why?”

“Nothing,” she sang. “I’m just wondering. I have to catch up with my best friend, you know. It’s been forever.”

“It’s been the whole of four days.”

“It’s been forever,” she restated, jumping up and spinning Y/N around (who couldn’t help but allow a slow grin to spread across her face).

“I was going crazy in there.” Y/N’s voice was considerably more serious. “I never told you, but--” she chose to ignore the look of anticipation written all over Rena’s face, “--Malfoy talked to me. And he was so nice to me, it was we--”

“That COWARD!”

The outburst started Y/N, who dropped her things on the floor in shock. “I’m sorry? Rena, what happened?”

“I can’t tell you,” said Rena, her tone dutiful and mournful. “It’s not my place. Anyways, what did that loser do?”

“Er,” began Y/N, “I don’t know how much of it was real or if it was because I was on pain potion, but he and I--I don’t know, flirted? There was a lot of banter, and before he knew it he pulled me off the ground--”

“You were on the ground?”

“--he pulled me off the ground and picked the gravel out of my palms.” Y/N swallowed as she recounted the instance. She’d never seen him look so soft before. “He said he had something he wanted to tell me, and his voice got all strange.”

“And then?”

“And then Madame Pomfrey came to yell at me and basically--oh god, Rena, she basically told him that I dreamt of him!”

Rena snorted with laughter. “Shit, dude. I don’t think you should worry, though. You’d think any bloke with half a brain would’ve figured out that you were obsessed with him by now.”

“Shut up.” Y/N’s face was hot. “Anyways, I haven’t seen him since. I’d prefer if we could stop talking about this.”

“Sure, sure.” She took in a breath. “Wait, what about rounds? Don’t you still have to see him?”

“No. Flitwick told me I’m off. At least until next month.” If she sped through the thought, it didn’t hurt as much.

“Ending of a chapter, huh? How are you feeling about that?”

Y/N sighed. “Honestly, Rena, I love you, you know I do, but I don’t want to talk about this anymore. Okay? It’s over.”

If her words carried any deeper meaning to Rena, she didn’t show it. “Lighten up, girly. Maybe it’s not.”

“All I’ve done is make a fool of myself,” lamented Y/N, throwing her empty satchel in the closet and collapsing onto her bed. “I’m just going to go back to what everything was before. This hasn’t changed anything. Now, Rena, I have a Potions exam to study for.”

“Whatever floats your boat.”

~

Her interactions with Draco were few and far between in the following weeks. Sometimes she caught a few glimpses of a pale blonde head of hair as she walked down the halls to her classes, but nothing concrete, nothing even close to the amount of interaction they had while she was still bound to her rounds.

It was certainly a punch in the gut--after all, she did spend a good portion of her academic career thirsting over him--but the sensible part of her knew that this was for the better. Her schoolwork became her top priority again, just like it had been the years before she was assigned to be his partner.

So, given this pattern of communication, it was fair to say that Y/N was completely and utterly flabbergasted when she saw Draco waiting by the entry of her common room at 11pm one night.

“Can I help you?” she asked as she shifted the books in her satchel to be secured over her shoulder.

“Yes, actually,” he said smoothly, not tripping over his words in the slightest. “I have rounds tonight.”

“I’m aware.” She hoped that he couldn’t hear her heart pounding the way that it was.

“And I’m out of Wide-eye potion.”

“That really sucks,” Y/N said as she held up her hand on the door of the common room, uttering the riddle’s answer under her breath before she stepped in.

“Wait!” His voice turned her around--it was pleading, almost desperate. “I have an exam tomorrow. No one in Slytherin has any. Snape would kick my arse for waking him up now. I know you have some left over since you never finished the rounds, and I--I understand if you don’t want to but it doesn’t have a very good shelf life anyways and I was hoping you’d...that you’d be alright with giving it to me.”

She paused, completely stunned. The most hopeful part of her wondered if he had made this up, but she squelched this with a force that nearly knocked the wind out of her. “Fine. Come with me, you must be freezing outside.”

Y/N wasn’t wrong--the weather had taken a turn in the past few days to be bitterly cold--but it wasn’t like she’d object seeing him for any longer. She mentally cursed herself for being so weak-willed.

Draco looked pleasantly surprised at the suggestion and stepped into the common room with her, following her up until she reached the base of the stairs. “I’ll wait here.”

“If you’re comfortable,” she began, “I’d honestly prefer if you came with me. I don’t want to explain to anyone why I let you into our common room unsupervised.”

He looked like his mind was buffering the information for a second, standing with a glazed look in his eyes before he sucked in a breath and became the picture of confidence once again. “Want me in your room that bad?”

Yes.

“You wish.”

He scoffed as they climbed the stairs, Y/N a few steps above him. She thought that if she maintained the space he wouldn’t see how hard she was shaking and wondered where Rena was. Studying with Hermione like she told her she was? She hoped.

Y/N stopped in front of her door at the very end of the hall, decorated with a banner that had their names displayed in glittering bronze letters that moved in the light. “Ok. You can come in with me if you want--it might be a couple minutes since I don’t quite remember where it is.”

He looked amused with himself as she got out her wand and attempted to unlock her door with the specialized charm she and Rena had decided upon. Mortifyingly enough, her hand was too shaky to execute it.

“Hey, hey,” Draco tutted, holding his hand out. It enveloped hers and held her wand still as she muttered the incantation, unlocking the door and swinging it open.

“Er...thanks,” she said. His hand was still over hers.

Y/N broke the eye contact to dart through the door to a thankfully dark and empty room--if Rena had seen that, she never would’ve let her hear the end of that--and began rifling through her drawers as Draco shut the door and examined her room.

“You’re flustered,” he noted as she tipped over one of her candlesticks and just barely managed to catch it. “Is everything okay? Trouble in paradise, little Ravenclaw?”

“Like you care.” Y/N shut the desk drawer with an audible BANG. “And don’t call me that. Rowena Ravenclaw is rolling in her grave hearing you infantilize her good name like that.”

Draco laughed from his stance by her door--a sound that she hated to admit that she really missed. “I take back what I said. You certainly sound like yourself.”

Y/N’s fingers finally closed around the last bottle of Wide-Eye, which was quickly tossed to Draco. “Happy now?”

He sent her a strangely weak smile as he slipped the vial into his pocket, no doubt silk lined and expensive. “Sure. So this is goodbye? Actually?”

“I think...I think so.”

Y/N had moved closer to him so only about a foot stood between them, a distance that felt like a mile from where she stood.

This is goodbye.

Draco was making a motion to turn around and open the door when Y/N experienced the most severe lapse of judgement in the entirety of her 17 years.

She sprung forward, her fingers curling around the satiny soft fabric of his tie and pulling. Her motion was rough enough that he jolted forward, his eyes wide with surprise as Y/N closed in and pressed her lips to his in a very chaste and ungraceful movement.

The split second that it took for her to realize the consequences of her actions was enough for her to let go completely and jump away, apologies readily falling out of her mouth in disjointed and clumsy collections.

“I’m so sorry...Oh my god...I have no idea what got into me...Draco, I--”

Before she could finish, his hands were already cupping her face, his frame bent down the slightest so he could be more level with her. And he was--oh--he was kissing her, actually properly this time, without the tense closed-offness of her first attempt.

When Y/N imagined what it was like to kiss Draco Malfoy, she didn’t imagine him to be so soft. Or warm. Or gentle, or pliant, or whatever other good things he was to her as he snaked her arms around her and held her tight to him.

His kisses turned feverish, almost desperate as he turned her so she was pressed up between him and the wall. Everywhere his hands touched felt charged with electricity and energy, and as his hands traveled up and down her spine she decided that this must be what it’s like to die of happiness.

“Draco,” she managed in between kisses, pulling away for air for just a moment and sliding back down so her feet touched the floor again. “Can we talk? About this?”

“Thanks,” he responded, his eyes glittering with endearment. “I almost forgot you were a Ravenclaw.”

“Shut up.”

He grinned but made no effort to step away from her, instead choosing to drag his fingers up and down the side of her exposed neck. “What’s there to talk about? I like you, you like me, there’s nothing we need to do to complicate this further.”

“You...you what?”

“Yes, genius, what else did you think I was planning on telling you that day in the courtyard,” Draco said. “I’ve been avoiding you because I thought you were over me. That was horribly embarrassing, you know. Had to nurse my ego for weeks before I could garner up the courage to speak to you again.” He stopped to gently press the pad of his thumb into the little dimple she had in her left cheek, smiling uncontrollably as he moved his hand back to cup her face.

“How was I supposed to know that?” argued Y/N.

“Isn’t this supposed to be the smart house?” he teased.

She slapped his shoulder. “Don’t make me decide I don’t like you anymore.”

“Oh, so you admit it?”

“Admit what?”

“That you like me?”

“I’m going to scream.”

“Just from kissing me? Wow, I must be good.”

“I mean it!”

“So do I!”

Y/N gazed up at the boy in front of her for a few beats, admiring how the moonlight bounced off the silvery strands of his hair and how his smile reached every corner of his face.

“I take back what I said,” she told him.

“Oh, and what is that?”

“This isn’t goodbye.”

He smiled again, leaning in close so his lips barely brushed her ear. “No. No, it isn’t.”

#draco x reader#draco malfoy x reader#draco malfoy#dracotok#draco#draco imagine#draco malfoy imagine#draco x y/n#draco x oc#draco malfoy x y/n#draco x you#draco malfoy x oc#draco malfoy x you

373 notes

·

View notes

Text

Broken Compass

Commission made by a lovely anonymous.

The Pitch: Hurt/Comfort with The Pirate King

3.2k words

Three fingers tap restlessly on a wooden desk.

It's made of heavy mahogany wood, its brown so deep it looks black by the faint light of a red candle. The desk fills almost half of his spacious cabin, so massive it sprawls from windowed wall to windowed wall. Thick gnarled legs stand heavily on a ground that is never still, always moving. Undulating in perpetual patterns with the waves.

The surface of the mighty desk is almost completely filled. Maps and letters, eyeglasses and compasses. Scattered feathers, some grandiose and colorful, others brown and plain. Overflowing ink bottles, glass rulers and charcoal pencils. One single dagger, stuck in the corner of a sprawling blue chart depicting an ocean no eyes but his can understand the name.

The desk The Pirate King uses to rule over his fleet. His empire.

He's not looking at any of it.

The candle is set on a silver candlestick, right beside him. It's tall enough that the orange glow flickers close to his face as he hunches over. Warm flames lick at the skin of his cheeks, warming his lashes. Hot wax pools on the center near the flame, while a steady stream falls down the candle towards the bottom.

Red wax made light by heat, but deep still. Flowing down like warm blood. Like blood...

The Pirate closes his eyes and his teeth clench into a snarl at the pressure building behind his eyelids. His fingers pause their mindless tapping as he slowly curls them. He feels his stump dig into his palm, feels his lungs closing in on themselves, feels the hot-black fury spread like wildfire through his veins.

Feels the terrible, soul-sucking concern twisting in his stomach.

Hakuho.

Helpless. Worthless. Weak. He can't do anything but stand here, worrying. As if he's a frail old man and not the leader of the largest pirate congregation ever born on the Mediterranean.

Where are you, my treasure?

The candle rattles on the desk as he punches the table, knuckles hitting the wood with a dull thud. The pain that bursts from his wrist and shoots up his arm is grounding. Awakening. It keeps him alert, focused on his anger and not his doubts. Not on that voice that keeps whispering, no matter how many threads he makes at it, that it's too late. That he did nothing, and now he has lost the one thing he couldn't buy or steal back.

He hits the wood again. Harder this time. Feels his skin break. Fury leads you to action.

If only he could do anything else but stand here.

The Pirate known as King lifts his fist high above his head and slams it down onto the desk with as much force as he can. One of his rings digs hard into his finger, and blood flows down his hand. The candle shakes precariously, flames throwing his cabin in swirling shadows, as he punches it for the fourth time. One of his nails pops from its place. The pain makes him see red.

Outside, the night is both starless and moonless. No clouds or wind. Nothing at all but the black depths of a sunless sky. It presses against the glass of his grandiose windows almost physically. It's as if The Pirate can feel it pushing in, wanting to get to him. Charged with unnamed energy. An omen of things to come.

A night that perfectly reflects his soul.

Six days.

His black eyes, as black as the night outside, are fixed on a letter resting near his fist. The letter is brief, the words inked into the white paper written in a quick hand. Messy and tight as if the person writing it was already thinking three sentences ahead. He always laughed at how perfectly your handwriting matched yourself.

Impulsive and full of peaks and lows and absolutely beautiful.

The date on top marks a fortnight to this day. No other letters had arrived since, no messengers or birds. Not even a smoke signal. Nothing.

It makes you six days late.

His heart hurts in his chest. The Pirate scans the letter again, as if the contents had somehow changed. As if he could spy some clue, some sign, something in it that could help him find you. Help him do something besides stand here and wait. Each day getting longer, each night colder.

But the black ink shining by candlelight says no more than he already knows. He has read the words so many times, he knows them all by heart now. His black eyes look down at the very end. At the words you always part ways in all your letters to him.

I'm counting the sunrises to see you.

Yours, always.

Binra.

There's a fingertip of your right-hand thumb marked by ink next to the goodbye. Another one of your quirks. The Pirate slowly uncurls his fist to press his own thumb to yours. Cold and lifeless. A poor replacement of the real thing.

He wishes he could hold your hand in his instead. Wishes he could smell your hair, and hug you close. Wishes he could have anything but the shallow comfort of a letter, with the last words you wrote to him.

The last words you would ever say to him.

The pressure in his head is too much, his ribs ache so strongly, he's sure his chest will cave in, and hot tears build just behind his eyes. No.

BOOM.

The yell that tears from his lips is drowned by the violence with which he hits the desk. The candle finally falls, hitting the ground as it's flame vanishes and his cabin sinks into shadow.

The night won. It got in after all.

All his quiet but his own heavy breathing, his whole arm shaking. He can't see anything, but his eyes are fixed down. To the letter he knows to be there. Your letter.

Binra.

"C-captain?"

The Pirate spins, letter clutched tightly in his hand to see one of his sailors at the door of his chambers. Light from the hall pools in, bathing the back of the young man's head, slipping its way into his dark chamber. He's glancing around, trying to find him with squinting eyes.

The Pirate can't believe he didn't hear the door opening. I haven't slept in two days. "What?" he barks, and the seaman jolts, wide eyes finally landing on him.

The Pirate scowls darkly as he watches the boy hesitate. "Captain, the- the," he stutters, and The Pirate takes a step closer. The man visibly pales, but he seems to finally pull himself together. He straightens his back, and his voice is firm when he speaks next. "The scouts have just returned."

The Pirate halts. "And?" he asks. A weight in his stomach, stupid hope sparkling in his chest.

Spirits, if you can grant me anything, grant me this.

The crewmember looks him straight in the eyes. "Good news, Captain," the boy smiles. "There's sings of life. And we have a location."

He doesn't answer. Not immediately. The Pirate looks down, at the letter now scrunched up tight in his fingers. A fortnight. Fourteen nights since you've gone silent in your mission. Six days since you were supposed to arrive here, at his ship.

Six days since he was meant to have kissed you.

He takes a deep breath, and when The Pirate King looks back up, his smile is wide. Full of teeth, as sharp as the axes he pulls from his belt.

He stands tall in the middle of his cabin, as blood rushes madly by his eardrums, pounding in a chant that has his whole body singing in unison. They sing for blood. For revenge. They sing for you.

The boy is looking at him with fearful eyes, but The Pirate makes sure to give him his best smile. "Lead me to the scouts," he simply says.

And the man takes up running.

Binra. I'm coming, peach.

- - -

You wince at the dawn of day.

(…)

Here is a sneak peek! The full commission is available on Ko-fi for one-time supporters (this includes those who have requested a commission or donated!) or monthly subscribers!

The Commission.

Thank you for making the request! 🖤

39 notes

·

View notes

Text

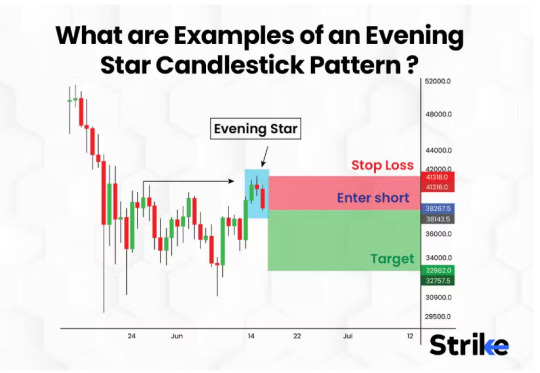

🎯 Evening Star Candlestick Pattern: The Ultimate Guide for Smart Traders

Understanding candlestick patterns can be a game-changer. Among them, the Evening Star Candlestick stands out as a reliable bearish reversal signal — especially when you're trading in markets like NSE, BSE, or Bank Nifty.

If you've ever spotted a strong uptrend suddenly fizzling out, it might have been an Evening Star trying to whisper its warning. Let's break down this pattern with real-world Indian stock market examples, research-backed insights, and pro-level charting strategies using tools like Strike Money.

🔍 What Exactly Is the Evening Star Candlestick Pattern?

The Evening Star is a three-candle formation that appears at the top of an uptrend, signaling a potential reversal to the downside.

📌 Here’s how it looks: 1️⃣ A large bullish candle showing strong buyer interest 2️⃣ A small-bodied candle (can be bullish, bearish, or a Doji) indicating market indecision 3️⃣ A large bearish candle that closes well into the body of the first candle

This pattern reflects waning momentum, hinting that buyers are exhausted and sellers are gaining control.

👨🏫 Credit for popularizing this goes to Steve Nison, the father of Japanese candlestick charting in the West. He introduced this pattern in his book Japanese Candlestick Charting Techniques — now a staple for every serious trader.

🔦 How to Spot an Evening Star Like a Pro

You don’t need a PhD in finance — you just need to know what to look for 👇

✨ Use a clean candlestick chart on Strike Money, TradingView ✨ Look for a recent strong uptrend — the pattern only matters at the top ✨ The first candle must be a strong bullish candle ✨ The second candle should gap up slightly and have a small body (a spinning top or Doji) ✨ The third candle should be bearish and close below the midpoint of the first candle

📉 Real Example: Reliance Industries (NSE: RELIANCE) On August 29, 2022, Reliance showed a textbook Evening Star on the daily chart. After three sessions of upward momentum, a Doji formed, followed by a sharp bearish candle that closed below the previous day’s open. What followed? A 6% drop in the next 5 sessions.

🌅 Evening Star vs Morning Star: Opposite Ends of the Spectrum

Ever heard of the Morning Star? It’s the bullish twin of the Evening Star — found at the bottom of a downtrend and signaling an uptrend reversal.

💥 Here’s how they contrast: 👉 Evening Star = Bearish Reversal at the top 👉 Morning Star = Bullish Reversal at the bottom

In fact, many traders combine both patterns to time entries and exits — for example, exiting a long position at an Evening Star and entering a new long on a Morning Star.

🧠 What the Evening Star Says About Market Psychology

Every candlestick pattern tells a story — and the Evening Star screams "buyer exhaustion."

🎭 First, bulls are in full control (first candle) 🕯️ Then, hesitation sets in (second candle) — traders aren’t so confident anymore 💣 Finally, bears strike (third candle) — and panic sets in

In other words, the Evening Star isn’t just a pattern — it’s a shift in sentiment. And when sentiment shifts, price follows.

📊 Is the Evening Star Pattern Actually Reliable?

Let’s talk data. Because trading isn’t just art — it’s part science.

📚 In a study featured in "Encyclopedia of Candlestick Charts" by Thomas Bulkowski, the Evening Star pattern had an average performance rank of 42 out of 103 — with a success rate of over 70% when used on daily charts with other confirmation tools.

🧪 In India, analysts using Strike Money’s backtesting tool found that combining the Evening Star with RSI (overbought > 70) or MACD bearish crossover increased accuracy significantly.

⚠️ However, without confirmation, false signals are common — especially in low volume zones or sideways markets.

🛠️ Entry and Exit Rules: How to Trade the Evening Star Like a Pro

You’ve spotted the pattern. Now what?

🟢 Enter Short: After the third candle closes below the midpoint of the first candle 🔴 Stop Loss: Above the high of the second candle (or the entire pattern) ✅ Take Profit: At next support level or based on risk-reward ratio (e.g., 1:2)

🧵 Example from Bank Nifty Futures (March 2023): An Evening Star formed on the hourly chart. Entry at 42,750, SL at 43,000, target at 42,200. Within 3 hours, the target hit. A clean 1:2 risk-reward win.

Trading patterns without a plan? That’s just guessing. A structured approach is everything.

🔍 Best Indicators to Confirm the Evening Star Pattern

Patterns alone don’t cut it. You need confirmation indicators for better accuracy.

📈 RSI: Overbought conditions above 70 can validate the reversal 📉 MACD: A bearish crossover strengthens the sell signal 📊 Volume: Higher volume on the third candle adds credibility 📏 Moving Averages: Price rejection from 50/100-day MA boosts signal quality

💡 Tip: On Strike Money, you can combine these indicators in a custom workspace for smarter pattern validation. This tool’s real-time alerts also help you catch live setups.

🌐 Evening Star Pattern in Indian Markets: Stocks, Forex & Crypto

The Evening Star doesn’t discriminate. It works on: 💹 Stocks like TCS, HDFC Bank, Infosys 💱 Forex pairs such as USD/INR — especially during volatile sessions 🪙 Crypto like BTC/INR and ETH/INR — works great on 4H and daily charts

🧪 Example: Tata Motors on February 2024 showed an Evening Star on the daily chart around ₹930. Post-pattern, the stock retraced to ₹860 over 8 sessions — that’s a 7.5% drop.

📍 Markets may differ in volatility, but psychology is universal — and so is the Evening Star.

🚫 Common Mistakes Traders Make With Evening Star

Mistakes cost money. Here are a few to avoid ❌

😵 Ignoring volume: Low volume can fake you out 🚫 Forcing the pattern: Not every three-candle setup is valid ⏱️ Trading too soon: Wait for candle close, not just pattern formation 📉 Skipping confirmation: Use RSI, MACD, or Strike Money’s signals to back it up

If you’re new, always practice on a demo account or use paper trading on Strike Money before risking real capital.

🤔 Should You Add the Evening Star to Your Trading Strategy?

Here’s the deal — no pattern is perfect. But the Evening Star is backed by psychology, data, and decades of use.

📌 It works best on: ✅ Daily or 4H charts ✅ Trending markets nearing exhaustion ✅ When used with confluence signals

If you’re a technical trader, adding this to your strategy toolkit can help you catch early reversals before the herd reacts.

And if you're using a smart charting platform like Strike Money, you're already one step ahead — with real-time pattern detection, volume insights, and trade journaling all in one place.

💬 Final Thoughts: Let Price Action Guide You

The Evening Star is more than just candles on a chart — it's a psychological footprint of a shift in momentum. It tells a story that every trader should learn to read.

✅ Use it as a signal, not a guarantee ✅ Combine it with volume, indicators, and market context ✅ Practice and backtest — especially using tools like Strike Money

The next time you see an uptrend stalling, don’t just stare. Zoom in. Confirm. Trade smart.

0 notes

Photo

Spinning top, a frequently occuring candlestick pattern #tempertrader #trader #tradingbasics #tradingforliving #tradingforbeginners #tradingforex #tradeconsciously #tradefromhome #chartpartterns #charts #phycological #technicalanalysisforbeginners #technicalanalysis #forex #forextradingforbeginners #stocks #stockmarkettips #stockmarket #lowrisk #lowriskinvesting #lowrisktrading #strategies #strategictrading #strategictradeplanning #strategictradeplan #letsdoit #challengeaccepted https://www.instagram.com/p/CAb4CBlp_tX/?igshid=1n35amedswhtj

#tempertrader#trader#tradingbasics#tradingforliving#tradingforbeginners#tradingforex#tradeconsciously#tradefromhome#chartpartterns#charts#phycological#technicalanalysisforbeginners#technicalanalysis#forex#forextradingforbeginners#stocks#stockmarkettips#stockmarket#lowrisk#lowriskinvesting#lowrisktrading#strategies#strategictrading#strategictradeplanning#strategictradeplan#letsdoit#challengeaccepted

7 notes

·

View notes